In terms of the Stamp Duties Act, 1993, a revenue stamp for a specified amount must be attached to the first page of the document or in certain instances (where the duty is a very large amount) paid duty can be denoted by the endorsement on the lease of a certificate of due payment (this is done at the Revenue Office). Duplicate original copies of a stamped original must be stamped with a N$1.00 stamp.

Although the lessor (the property owner) must stamp the lease, most leases stipulate that the lessee (the tenant) has to bear the cost of revenue stamps. Leases are stamped to raise revenue and not as a formality to make the lease valid. Unlike the sale

of land, a valid verbal lease agreement may even be concluded between parties; however, once written a lease agreement should be stamped according to the Stamp Duties Act.

If the stamps are not attached and cancelled (by initialing them and adding the date) at the time of execution of the lease, either the owner or the tenant can attach and sign the stamps within 21 days. Even if the lease is not stamped within this period, the contract between the parties does not become invalid.

The problem is: In terms of the Act an unstamped document may not be presented until it is stamped. In short, no one can approach the Courts for relieve with an unstamped document/lease agreement.

The adhesive stamps must be defaced by the person who is required or authorized to stamp the document. The defacing entails the writing of such person’s name of initials in ink on or across the face of the stamp(s) and writing the date upon which the document was stamped and so as to render the stamps incapable of use on any other document.

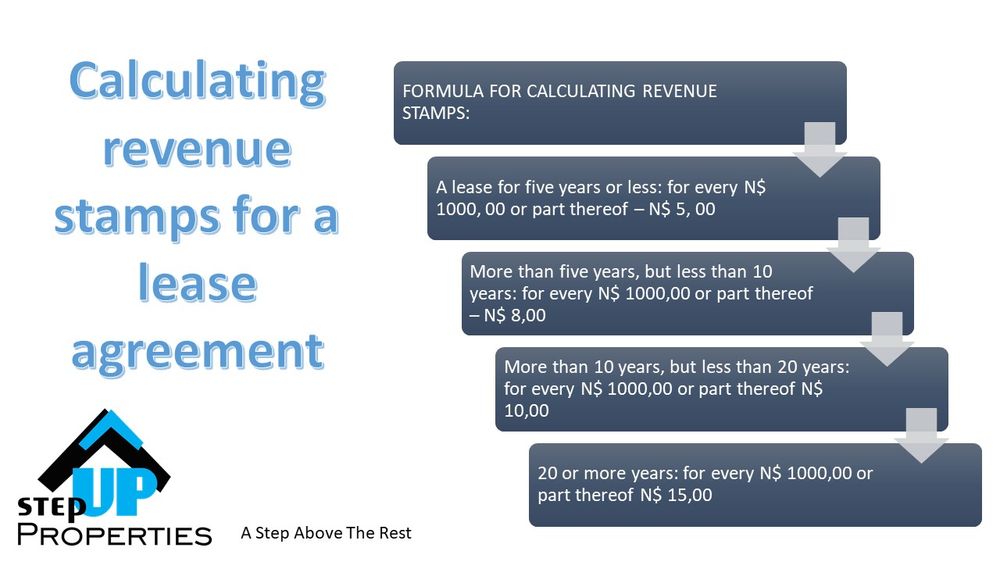

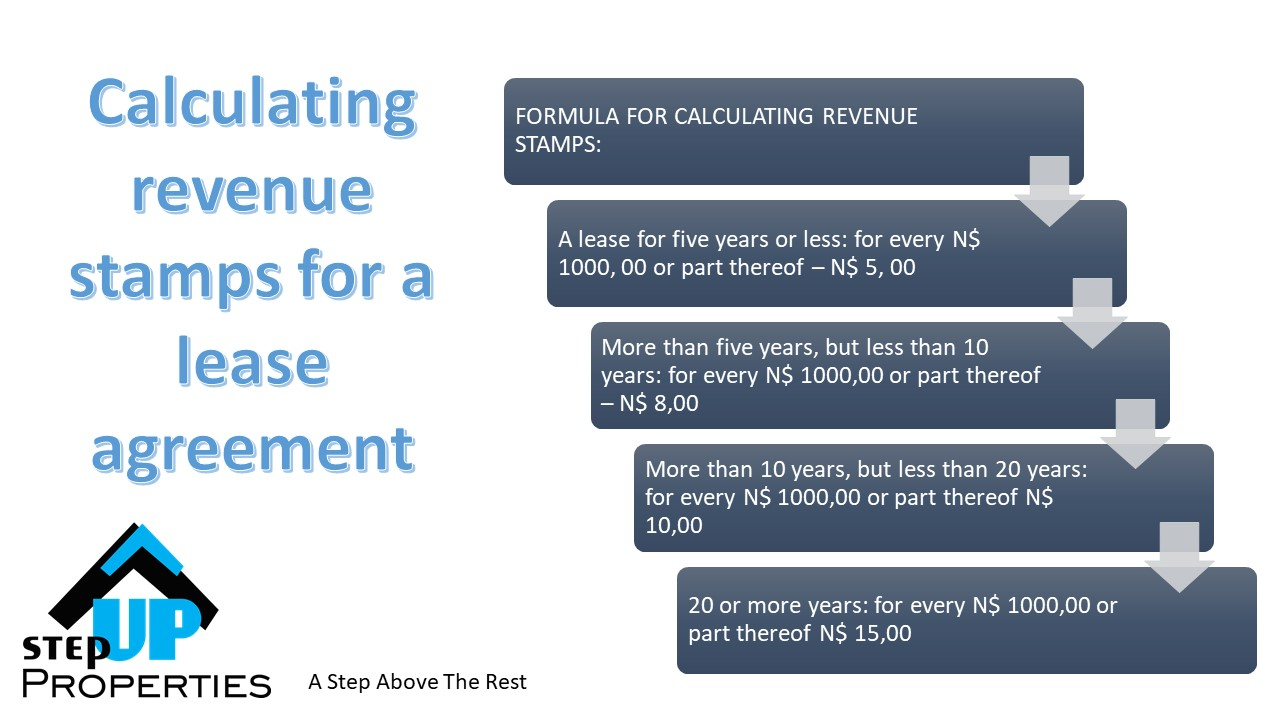

The Stamp Duties Act has a formula for calculating the stamp duty on a lease. In complex cases you may need expert advice such as the cash office at the Receiver of Revenue.

In certain instances, stamp duty can be refunded, upon application to the permanent secretary of the Ministry of Finance. For instance where the lease is terminated before the end of the period for which duty has been paid, a refund can be claimed.

Penalties

The Act makes provision for a fine or penalty to be paid for late stamping (generally, the attachment to the document of penalty stamps equal to the value of the penalty payable).

If the stamps have not been attached and signed within six months of execution of the lease, twice the normal duty will have to be paid in addition to the normal stamp duty.

A penalty of three times the stamp duty will be imposed if, after more than six months of the starting date of the lease, the stamps have still not been attached and signed.